We are pleased to present our third quarter 2020 Market Letter titled, “Start Me Up.”

Investment Strategy Webinar Recording: Post-COVID Sector Outlook

On Wednesday, June 10, our Chief Investment Officer, George Hosfield, CFA, and our investment team analysts Ralph Cole, CFA, Brad Houle, CFA, Peter Jones, CFA, Shawn Narancich, CFA, and Jason Norris, CFA, gave a webinar where they discussed our sector-specific outlook in a post-COVID world.

Webinar Video: Q3 Mid-Quarter Strategy Update

A New Outlook on Earth Day

Wednesday, April 22, is the 50th anniversary of Earth Day. In 1970, U.S. Senator Gaylord Nelson and activist Denis Hayes launched a nationwide environmental “teach-in” that later became Earth Day. Although the pandemic may have disrupted plans for this milestone anniversary, if Senator Nelson were alive today, he would find emerging business practices of interest.

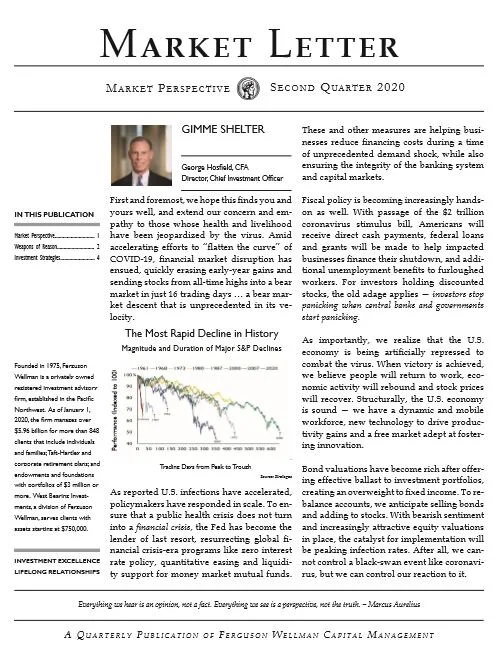

2020 Q2 Market Letter: Gimme Shelter

Second Quarter 2020 Investment Strategy Video: Gimme Shelter

We are pleased to present our Investment Strategy Video for the second quarter of 2020 titled, “Gimme Shelter.”

High Anxiety

Staying in touch with clients is critical during such extreme market volatility. Admittedly these are highly stressful and uncertain times for everyone. It is paramount that we stay safe, remain calm and strive to make decisions that are aligned with our long-term goals … not current headlines.

Investment Outlook Video Q1 2020: Age Is Just a Number

George Hosfield, CFA, chief investment officer for Ferguson Wellman and West Bearing Investments, shares the firm’s outlook for 2020.

Outlook 2020

Having climbed the proverbial “wall of worry,” all the major domestic equity indices are poised to end the year at, or near all-time highs. In fact, it was a great year for virtually every asset class as bonds enjoyed their best return in a decade, international equities returned roughly 20 percent and real estate and commodities have also prospered.

Investment Strategy Video Fourth Quarter 2019: Holding Pattern

Fourth Quarter Market Letter 2019: Holding Pattern

Investment Strategy Video Third Quarter 2019: Mounting Headwinds

Market Letter Third Quarter 2019: Mounting Headwinds

Second Quarter 2019 Investment Strategy Video: Delayed Arrival

2019 Market Letter Q2: Delayed Arrival

Q1 2019 Investment Outlook Video

Outlook 2019

After six years of exceptionally low “turbulence,” volatility returned with a vengeance last year. We expect this bumpy flight path to persist as investors digest slowing economic expansion, materially lower earnings growth and broadening trade and political tensions.